Over the last 18-24 months, during the so-called ‘first wave’ of cyber insurance, growth has been driven by premium increases. However, in the next 18-24 months, the ‘second wave’ of cyber insurance growth will be driven by market expansion, particularly in the small to medium-sized enterprise segment (SMEs). And undoubtedly, the threat landscape will continue to evolve at a faster pace compared to the past. The COVID-19 pandemic expanded the attack surface for all businesses and Russia’s invasion of Ukraine has heightened the risk of cyberattacks. Even today, one in every five SMEs remains uninsured or underinsured.

In a recent report, Gallagher Re predicts that “2023 [will see] the start of cyber’s second growth wave.” The report adds: “For Cyber, at least for now, the link between premium and exposure has been severed.” These two sentences summarize well why Cowbell Cyber has established its role as the leading provider of cyber insurance for SMEs – in the shortest period of time and with the smallest amount of capital.

We believe that providing transparency between premium and exposure is crucial for all: maintaining trust with policyholders and building a robust model to grow a cyber insurance business responsibly. Today we announced $100 million Series B funding led by Anthemis Group with participation from Permira Funds, PruVen Capital, NYCA Partners, Viola Fintech and all our existing investors to further revolutionize Cyber Risk underwriting. I am very proud of this syndicate and could not have asked for better partners at this juncture in our journey. Matthew Jones, Nic Volpi, Victoria Cheng, Stephanie Khoo and Tomer Michaeli we have met our match and are ready to take on any new challenges fearlessly.

Our latest round of funding will directly contribute to strengthening our highly differentiated model:

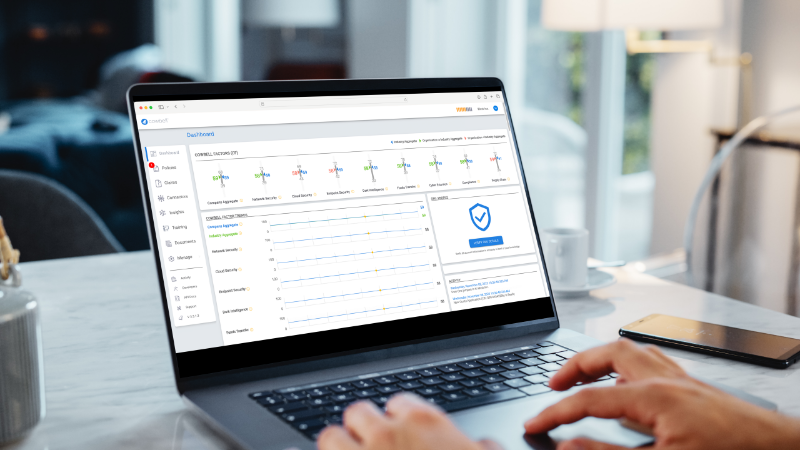

- Improving broker efficiencies in the distribution of cyber insurance: Customized quotes in a few clicks, policies issued in minutes – this is what Cowbell is known for. We rolled out API-based instant quoting in 2021 and will continue to make it easier and faster for the 13,000 appointed producers to issue relevant coverage to SMEs as the only real-time Rate-Quote-Bind (RQB) workflow in the market.

- Investing in closed-loop risk management for policyholders: We are augmenting the resources allocated to helping policyholders build cyber resiliency with further investments in continuous risk assessment, underwriting, incident preparedness and response teams, and expansion of our partner ecosystem. Our goal is to enable policyholders to deploy a closed-loop approach to cyber risk management where they assess, insure and improve risk continuously. Today, with 23 million SMEs in our risk pool ( expected to reach 32 million by EOY), any new risk we underwrite has a 71% chance that we are continuously assessing risk for that business for the last 2 years.

- Funding risk-bearing capabilities to augment reinsurance: Our reinsurance captive, Cowbell Re, went live in January in support of our Prime 250 program, arguably the best cyber insurance product in the market in both admitted and non-admitted markets. This underscores our commitment to cyber specialization and collaboration with our reinsurance partners. Despite 40x growth in premium during 2021, our loss experience remained among the industry’s best and as we triple our policyholder base during 2022 we expect to further improve on our loss ratios.

Our mission remains unchanged: Cowbell is known for closing insurability gaps, bringing transparency in risk selection and pricing, and offering relevant and customizable coverage, all while extending the value of cyber insurance with risk management solutions that enable organizations to strengthen their resilience to cyber attacks. We aim to lead this second wave by revolutionizing cyber risk underwriting.

Lastly, I would be remiss if I did not mention the loyalty, dedication and hard work of the 138 Cowbellers without whom this milestone would simply be impossible. Today, these 138 proud faces are displayed on the seven-story Nasdaq wall in New York City Times Square, 4 seconds each, 10 times each hour, for the entire day. They embody the cultural traits of Cowbell in speed, inclusivity, innovation, transparency, and empowerment.

Finally, my sincere thanks to all our broker partners for their trust and support along this journey and for actively contributing to making this next chapter a reality. We have amazed a group of 13,000 producers with a single mission to serve the backbone of our nation – SMEs. Less than 20% of these organizations have subscribed to a cyber policy and two-thirds are not familiar with cyber insurance, making this the most underserved market among all insurance lines of businesses. We remain committed to them.

More Cowbell!

Jack.