Cowbell Advantage

Closed-Loop Risk Management

Robust adaptive cyber insurance services built on top of an AI-powered platform designed to increase your organization’s insurability, give you up-to-date insights into your risk exposures, and to help you proactively mitigate threats and potential losses.

Our closed-loop approach to risk management increases your organization’s insurability, offers complete insight into risk exposure, and empowers you to take control of loss mitigation.

Assess

Use Cowbell Factors™ to quantify your risk exposure and learn exactly how much and what types of coverage your business needs.

Insure

With your broker, determine insurable threats and their financial impacts to develop a cyber insurance policy custom-designed to suit your risk profile.

Respond

Cowbell’s security and insurance experts are on-call and always ready to immediately help you with a full range of post-incident recovery services.

Improve

Receive continuous risk assessments and recommendations to mitigate risk and optimize premiums via Cowbell Insights and the Cowbell Risk Engineering team.

Assess

Use Cowbell Factors™ to quantify your risk exposure and learn exactly how much and what types of coverage your business needs.

Insure

With your broker, determine insurable threats and their financial impacts to develop a cyber insurance policy custom-designed to suit your risk profile.

Respond

Cowbell’s security and insurance experts are on-call and always ready to immediately help you with a full range of post-incident recovery services.

Improve

Receive continuous risk assessments and recommendations to mitigate risk and optimize premiums via Cowbell Insights and the Cowbell Risk Engineering team.

Assess

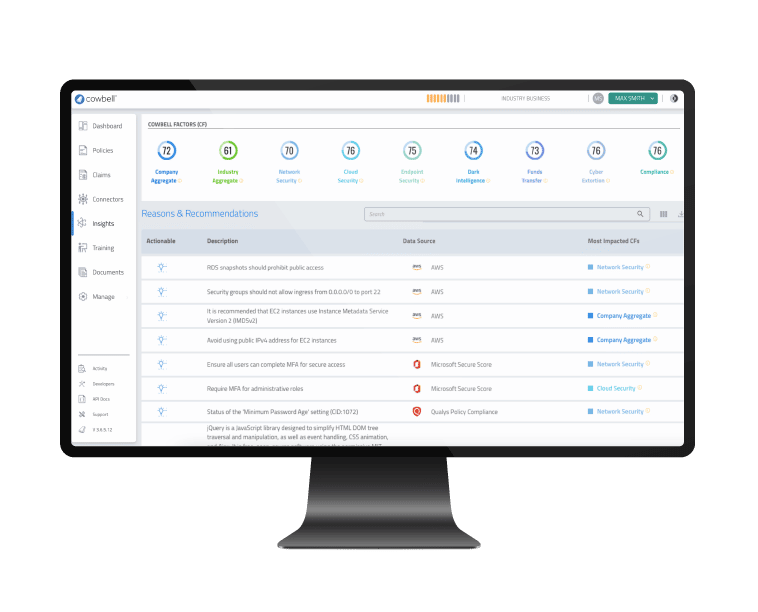

Quantifying risk exposure tells you exactly how much and what types of coverage your business needs. Mapping insurable cyber threats to quantified metrics readily reveals potential cyber vulnerabilities.

- Cowbell Factors™ provide a risk benchmark and a continuous risk assessment against our risk pool of millions of accounts.

- Cowbell Insights highlight vulnerabilities and act as an early detection signal for potential losses.

Insure

- AI-assisted continuous underwriting

- Customized coverage

- API-based instant quoting

- Rule-based underwriting referrals

Improve

Continuous observation means you can check your risk exposure and progress of your remedial action at any time. Continuous insights allow you to optimize premiums and mitigate risk.

- Cowbell Insights generate continuous, on-demand recommendations.

- Our Risk Engineering Team is available for live, consultative risk sessions. You can also work with one of our partners from the Cowbell Rx risk management marketplace to access a wide variety of security resources.

Respond

Always ready, the Cowbell Claims Team expedites incident recovery. Cowbell’s security and insurance experts are on-call and always ready to help you immediately with a full range of post-incident recovery services:

- Rapid, informed claims handling

- Claim specialists dedicated to cyber

- Claim insights shared across portfolio