Solutions

Cowbell for Businesses

Cowbell Cyber delivers standalone and individualized cyber insurance to small and medium-sized enterprises. Cowbell’s cyber policies include robust coverage bundled with continuous risk assessment and resources to mitigate identified threats and exposures.

Insure with Confidence

Cowbell brings transparency to cyber insurance with clarity of coverage, continuous risk assessment, and actionable insights to close insurability gaps and optimize coverage and policy configuration.

Get to Know Your Cowbell Factors

7 Reasons to Get Cyber Insurance

Resources

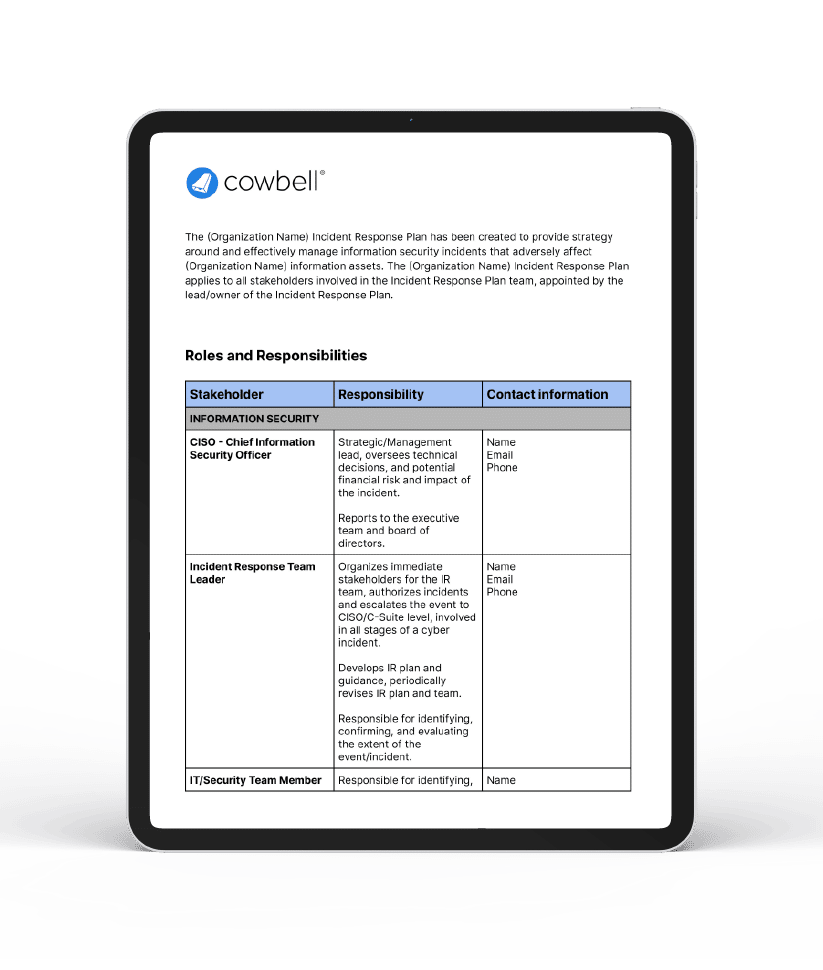

Cyber Readiness

Our incident response templates will help you get prepared for when you discover a potential cyber incident.

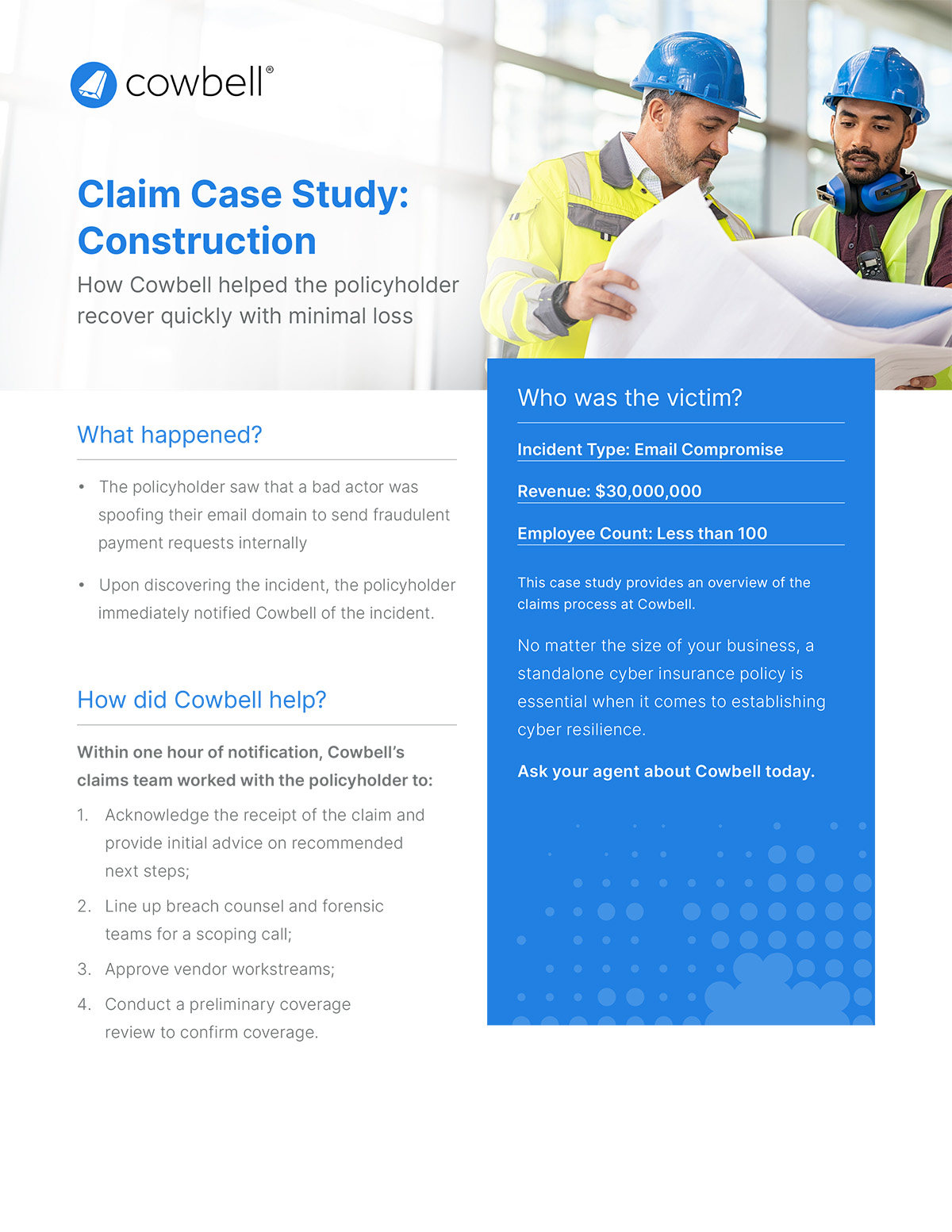

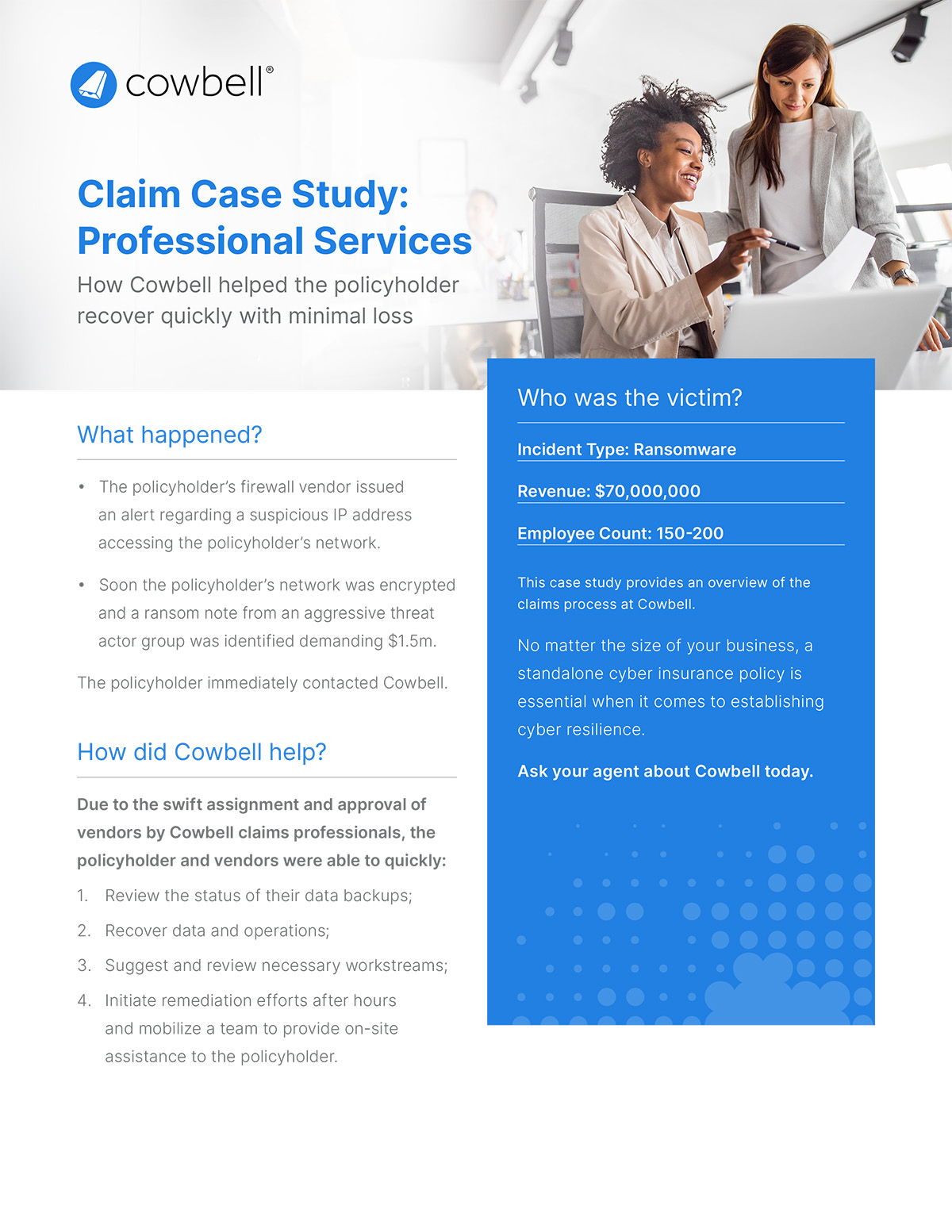

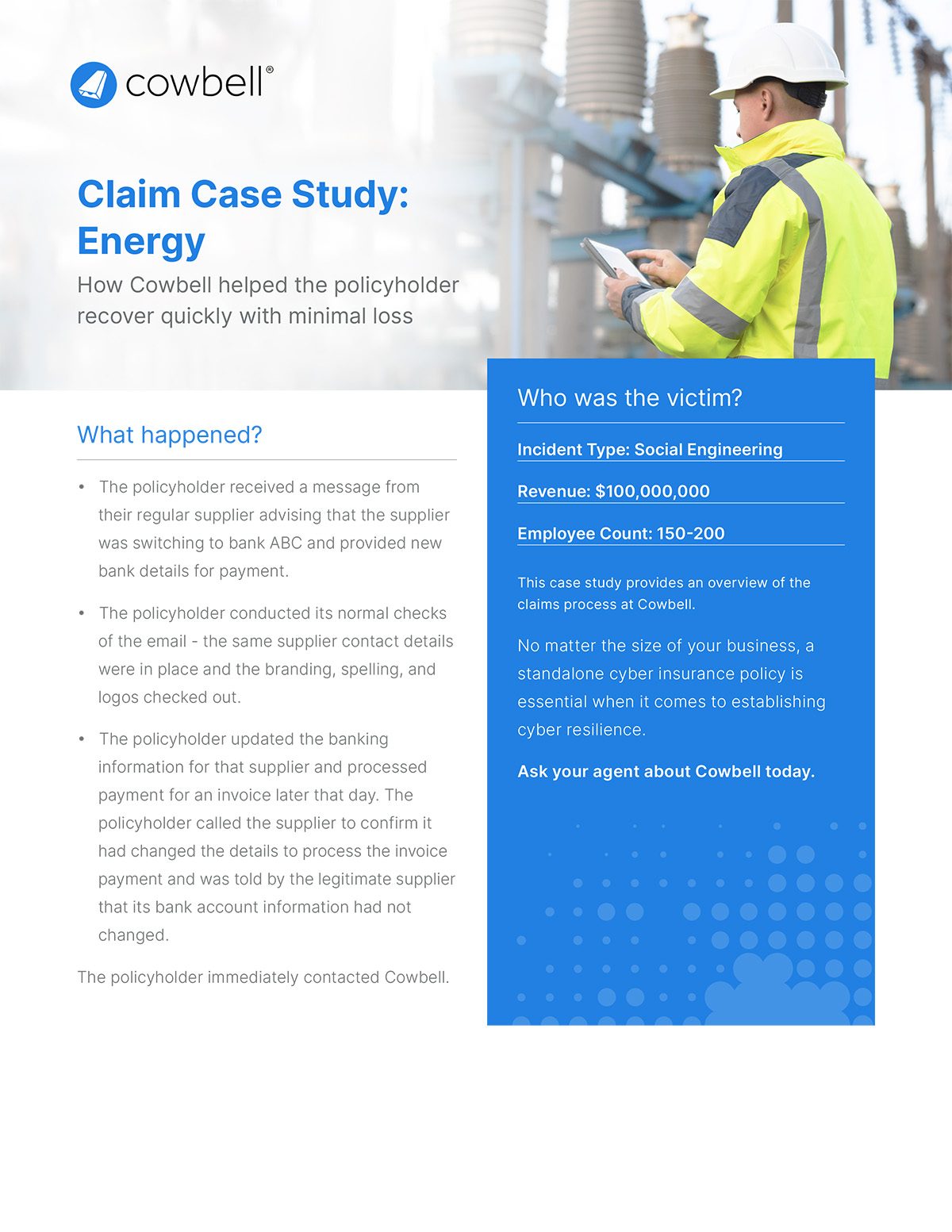

Claim Case Studies

How Cowbell helped a mid-sized construction business policyholder recover quickly with minimal loss.

How Cowbell helped a mid-sized professional services business policyholder recover quickly with minimal loss.

How Cowbell helped a mid-sized energy business policyholder recover quickly with minimal loss.

Recent Blog Posts

The latest news and insights from the Cowbell team.

CyberLine Quarterly: Unifying Cyber Risk, Professional Indemnity, and Management Liability

“What you’re thinking is what you’re becoming.” — Muhammad Ali. Over the past quarter, Cowbell has redefined the pace and potential of innovation in commercial insurance. To call our latest advancements mere milestones would understate their impact on the...

How Does BEC Lead to Payment Fraud? And What Can Businesses Do About it?

The blog below is written by one of our Cowbell Rx partners, SentinelOne. Learn More about how Cowbell and SentinelOne work together to deliver high-quality cybersecurity solutions to Cowbell policyholders. Business Email Compromise (BEC) leads to payment fraud...

Building Cyber Resilience: Your Guide for Internet Safety Month

As cyber threats grow in frequency and sophistication, businesses need to prioritize staying safe in this evolving threat landscape. At Cowbell, we believe Internet Safety Month is the perfect opportunity to review and reinforce your organization’s cybersecurity...