In insurance, data is priceless. Data provides information, insights, and delivers a competitive edge. Data can be turned into intelligence that feeds processes, enables automation, and avoids human intervention on repetitive, predictable tasks. Human intervention creates delays and comes with a non-negligible level of errors and bias.

By contrast, data-driven processes are fast, behave consistently, and with the advent of AI, data-driven decisions and processes can be a lot more accurate by being able to comprehend and make use of significantly more data than the human brain in a much shorter amount of time. AI can also raise the flag when there is not enough data, when the data is suspicious, or when human intervention is needed to complete a task.

This is where MOO™, Cowbell’s underwriting bot assistant comes into play.

Cyber is one of the most technical insurance lines of business. Cyber underwriting relies on the ability to identify, quantify, and price cyber risks prior to risk transfer through an insurance policy. Risk assessment starts with a macro-level review of a business and its industry. This can help define whether the organization is insurable for cyber risks.

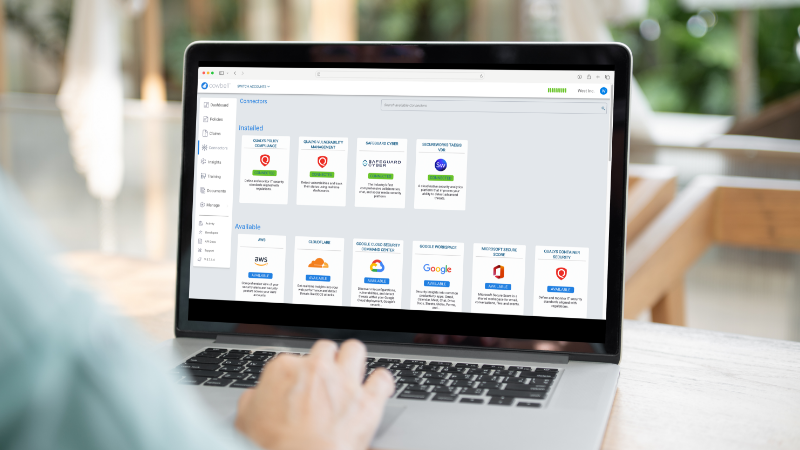

But it’s far from enough. A key component of risk assessment includes a review of the controls required to ensure that security best practices are implemented and enforced across the technology footprint of the business. The information might be embedded directly into systems, accessible externally through various scan techniques, already compiled in the many security systems deployed for activity log tracking or for regulatory compliance. So lots of data is already available to assess risk. MOO™ is at the core of the Cowbell platform automating many of the data processing steps to deliver unprecedented efficiencies, accuracy, and speed in risk selection and pricing.

MOO™ eliminates repetitive or data-driven tasks in the rating, quoting and binding processes. Just to describe a few:

- MOO™ assesses risk using AI and machine learning and accelerates the decision process for Cowbell’s underwriters;

- MOO™ automates underwriting for accounts that fit within Cowbell’s underwriting guidelines;

- In addition, as a ‘machine’, MOO™ can work around the clock, providing instantaneous answers to time-sensitive questions such as:

-

- Getting a quote indication for an account;

- Getting detailed information about Cowbell’s coverages;

- Tracking the progress of a quote that has been referred for manual underwriting;

- Checking for states where Cowbell is admitted (we are adding new states weekly);

- Tracking policyholder’s activity; when an insured signs an insurance application or makes a policy payment

- Immediate lookup into Cowbell’s platform for classes of business (NAICS codes) and other lists

-

While MOO™ is working inside the Cowbell cyber insurance platform and alongside Cowbell’s team of underwriters, it is also directly available to agents and brokers appointed to distribute our cyber insurance and can be integrated into Slack as a channel and an app to get the above information in real-time.

As a broker, if you have any question about activating MOO™, contact us at fhccbeg@pbjoryyplore.nv