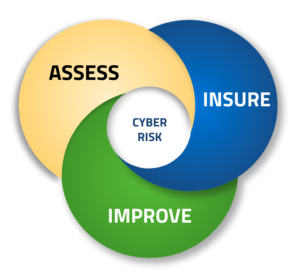

Cowbell’s standalone cyber policies provide a safeguard to businesses against cyberthreats and damages from cyberattacks on their digital infrastructure. Cowbell aims to be a different kind of insurance company by going beyond risk transfer and taking an active role in helping policyholders improve their risk profile. We bundle resources with our policies to identify, qualify, quantify, mitigate and prevent risks with the end goal to deliver a closed-loop approach to risk management:

ASSESS |

AI-Powered Continuous Assessment of Individual RiskCowbell goes broad and deep in its evaluation of individual risks, using hundreds of data points consisting of outside-in observations and inside-out risk data collected through partnerships with major infrastructure platforms and security vendors. Prior to underwriting, we benchmark and rate individual risk against a growing risk pool of millions of U.S. organizations that are ready to be quoted. AI gives us the computing power to compile Cowbell Factors, our proprietary risk rating factors, in real-time and to continuously update these ratings as our platform incorporates new data. |

INSURE |

Coverage Tailored to Businesses’ Unique RiskCyber exposure and risk profile are unique to each business and depend not only on size and class of business but also on the level of digitization and how technology is being deployed. Our AI-powered online approach to risk assessment and quoting highlights the best set of coverages and policy parameters for any specific business and empowers agents and brokers to customize quotes in a few clicks – add endorsements, change limits or deductible, and more. Cowbell’s underwriting engine instantaneously returns bindable quotes enabling policies to be issued in minutes. |

IMPROVE |

Insights, Services, and Training to Proactively Improve Every Business Risk ProfilePolicyholders gain the same access to their risk profile as Cowbell’s underwriting engine. With full visibility and on-demand access to Cowbell Factors, peer benchmarks, risk insights, and recommendations to address security weaknesses, policyholders can improve their risk profile and their risk ratings. Our ecosystem of partners brings expertise, resources, and bandwidth to policyholders to help fix security weaknesses. Pre-breach services help implement an incident response plan, educate teams about post-breach activities and familiarize them with every step of the response and a recovery process outside of a period of crisis. Our cyber policies include cybersecurity awareness training for the policyholder’s employees so that businesses can educate their workforce on how to steer clear of phishing emails and security blunders. |

Contact us directly to learn more about Cowbell and our cyber insurance programs:

- Businesses: fhccbeg@pbjoryyplore.nv

- Agents and brokers: ntrapvrf@pbjoryyplore.nv

- Security and service providers: cnegaref@pbjoryyplore.nv