Now more than ever we feel the stress of unforeseen events imposed on us and evolving in front of us with no ability to control the outcome. COVID-19 is changing how we interact, how we work, and much more. Everything we took for granted yesterday might be gone today, tomorrow, or in a week. The situation is catastrophic for many. These are also circumstances where we need to practice resiliency. When it comes to cyber, criminals have not been waiting, and we’ve already seen warnings about the rise of phishing and other email scams taking advantage of people and businesses struggling because of the impact of COVID-19. This blog explains why cyber insurance powered by continuous underwriting is critical.

Status quo cannot exist with regards to cybersecurity and equally so with regards to cyber insurance. In many ways, this is why Cowbell Cyber launched in 2019 with the mission to provide all enterprises, including small and mid-size businesses (SMBs) – easy access to standalone, relevant and personalized cyber protection through insurance. Because digital assets, data, and information technology are core to the risks being covered by cyber insurance, we felt that cyber underwriting could benefit significantly from technology innovations – from digitalization to automation and artificial intelligence. This is one reason why Cowbell anchored its innovative approach around continuous underwriting.

First, continuous underwriting is not a novel concept. It has been used in other insurance lines of businesses in varied forms. Let’s look at why and how it has been used:

- Worker’s compensation: with pay as you go Workers Comp, insurance premium is based and paid at the end of each pay period based on the actual payroll and type of work done. The premium liability changes and goes up or down based on changes in payroll, contractors and class codes.

- Life insurance: Royal London offers a unique life insurance for people living with diabetes with the insurance premium attached to the HbA1c test result, a measure of how well the patient is managing his/her diabetes. Benefits are numerous: more people with diabetes can now get Life Insurance and their premiums might go down over time with unbiased proof that their condition is under control. This process also gives better visibility into the underwritten risk to insurers.

Why is continuous underwriting so critical for cyber?

Cyber is one of the most technical insurance lines of business. It’s designed to protect organizations from the risks related to the use of the internet and information technology. But there is a continuous shift in risk exposures as cyber threats, the use of technology, and digitization initiatives are never static. This is why it makes no sense for cyber to be underwritten once a year at renewal time. Cyber policies should evolve at the same pace as the business they protect. In light of always-changing cyber risks, continuous underwriting is becoming an imperative for all: policyholders, insurers and the agents managing the relationship and the policies. Without continuous underwriting:

- Policyholders might rapidly get undercovered with limits that are too low for the volume of sensitive data they process, or technology initiatives that are not accounted for;

- Insurers become blind to aggregated risks that might be building up in their portfolio;

- In the case of an incident, agents might have to carry the blame for any gap in coverage.

Paving the way for Continuous Underwriting: Continuous Risk Assessment

Dynamically managing the chain of data and the processes that lead to sound, informed underwriting is a must. Automation, data, artificial intelligence, and data science are the technical pillars that make continuous risk assessment and underwriting technically feasible.

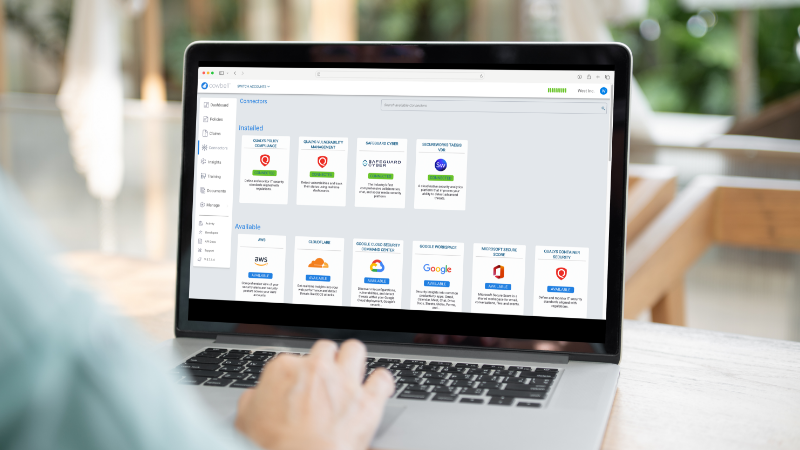

First, Cowbell platform collects data on a continuous basis – from accounts applying for cyber insurance through the various agencies we partner with. We also have access to data panels that we load in our platform from a variety of sources. Today, we have more than 600,000 accounts in our platform, with the goal to hit millions by the end of the year. This gives us the confidence that our assessment of risk for our targeted market (up to $100m for Prime 100, and up to $250m for Prime 250) is statistically sound.

Reaping the benefits of continuous underwriting and continuous risk assessment

The various insights generated are made available to all our partners and customers:

- Policyholders benefit from a real-time view into the risk exposures across our 7 Cowbell Factors, and how they compare to peers.

- Both agents and policyholders can visualize discrepancies between risk exposures and risks covered at the time the policy was bound and act accordingly to close any gaps in coverage.

- Insurers immediately benefit when policyholders keep their coverage inline with their risk exposures. They also gain access to the same data at an aggregated level for their portfolio.

In our next series of blogs, we will dig further into the benefits and challenges of continuous underwriting along with a discussion on Cowbell Factors, Cowbell’s proprietary risk-rating factors that are core to our ability to deliver on continuous underwriting and tailored coverages. Stay tuned.

If you want a demo of our platform or are interested in distributing our insurance product, you can learn more on Cowbell’s YouTube channel or by contacting us directly.