By now, we all know just how easy it is to fall victim to a cyberattack. Just one click on a phishing link, one misconfigured cloud system, or one employee who hasn’t set up MFA is all it takes.

Cowbell Cyber is on a mission to make cyber insurance accessible to all organizations. Insurance provides financial protection against cyberattacks. We also make it our mission to enable organizations to take control over their cyber risks and prevent cyber incidents by offering a wealth of risk management resources. Our goal is to enable our policyholders to deploy a closed-loop approach to risk management where they continuously assess risks, transfer them to insurance and improve their organization’s risk profile.

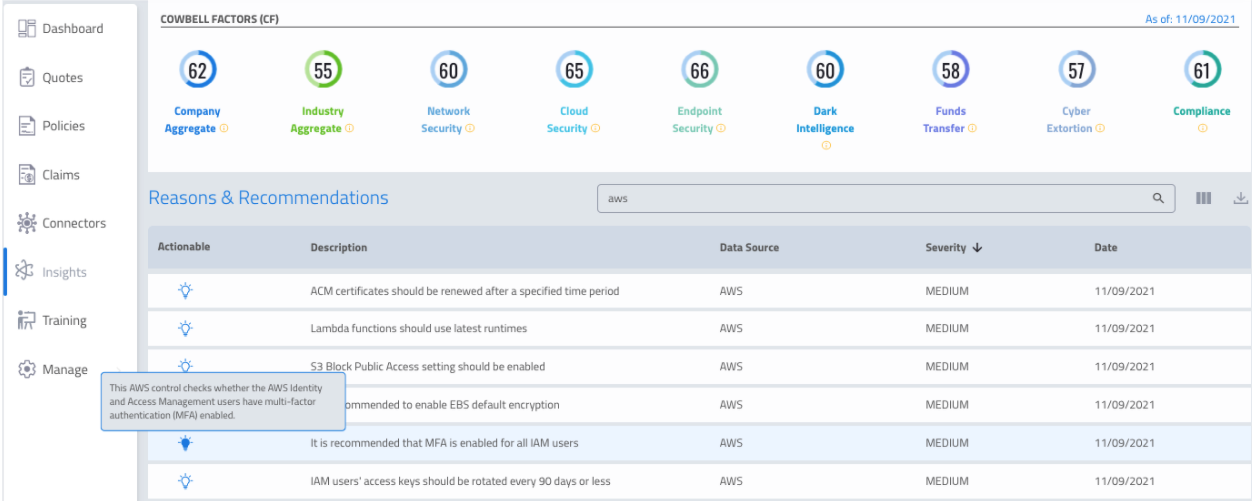

Our risk assessments are continuous, providing always up-to-date visibility into an organization’s risk exposure. We use outside-in and inside-out data to compile Cowbell Factors, our proprietary risk factors. Policyholders can get even more precise risk ratings and recommendations when they enable our risk rating engine to directly account for security configuration and best practices deployed on the organization infrastructure. This is why we have built connectors to some of the most commonly used IT systems and security platforms.

What are Cowbell Connectors?

Cowbell Connectors are API-based integrations to environments like AWS, Microsoft 365 (aka Office 365), or Qualys. We use standard APIs from these vendors to read metadata about configuration and use of security best practices. This typically informs our rating engine about the use of MFA, patching practices and more.

Now, all Cowbell policyholders can activate connectors and get deeper insights into their risk exposure. Policyholders on Prime 250 admitted or surplus papers become eligible for a 5% premium credit when activating one or more connectors.

As an example, most recently we worked with AWS to make it easy and self-service to activate our connector to AWS cloud.

Cyber insurance is one of the fastest growing lines of commercial insurance. Unfortunately, cyber crime is growing just as fast. If you are an insurance agent or broker, help us help your clients take control of their cyber risk. Cowbell makes it easy for you to present quotes for standalone cyber coverage to all your clients and for your clients, the policyholders to benefit from the wealth of free resources we make available for risk management.

If you are interested in helping your policyholders stay secure online, contact us at ntrapvrf@pbjoryyplore.nv.