At Cowbell Cyber, our goal is to make cyber insurance as comprehensive and accessible as possible. And while we mainly interact with insurance agents and brokers, our primary goal is to protect and deliver value to their clients: the policyholders. After all, they need to feel safe under our cyber policies, no matter how much or little experience they have with cyber.

Here are 11 ways on how we bring value to our policyholders:

1. Standalone cyber

Like the name suggests, Cowbell focuses solely on cyber insurance. That means for the policyholder that our policies are dedicated to cyber, that our coverages are designed to protect against a broad range of cyberattacks, and that we have security experts working with us if a cyber incident does happen. That also means that policyholders usually receive more support after an incident than they would with a data breach endorsement or cyber covered as part of another policy such as a Business Owner Policy.

2. Customized policies

Cyber is not one size fits all. Different businesses have different needs, depending on their size, line of business, and software they use, just to name a few. A generic policy will, consequently, not work for most.

With Cowbell, policies are customizable. Policyholders can choose their coverages, coverage limits, and deductibles, depending on their individual business needs. This ensures a policy that is tailored to its policyholder, preventing being underinsured or overpaying for coverages that are not needed.

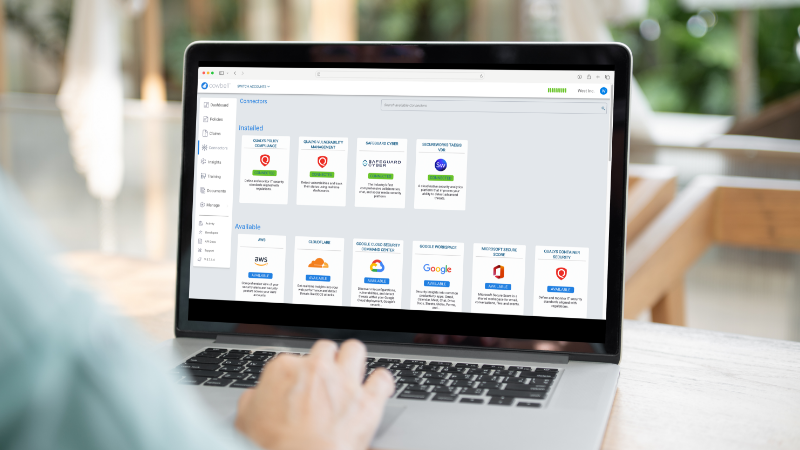

3. Continuous risk assessment

The cyber risk profile of a business is not only highly individual; it also changes constantly. That’s why it is important for policyholders to check and be aware of the risk they are exposed to on a continuous basis.

Cowbell Cyber delivers this continuous risk assessment. Powered by AI, policyholders’ cyber risk is compiled using outside-in and inside-out data and being compared to a pool of millions of other US-based companies. Quantification of risk, using a score between 0 and 100, is delivered through our proprietary Cowbell Factors. Cowbell Factors divide the risk into 7 comprehensive categories: Network Security, Funds Transfer, Cloud Security, Cyber Extortion, Endpoint Security, Compliance, and Dark Intelligence. This set of ratings delivers a holistic, up-to-date view of the company’s cyber risk exposure.

4. Risk insights

Cowbell Insights provide guidance to help policyholders improve their risk profile and maintain data security and privacy. Insights show: reasons behind your Cowbell Factors ratings, recommended actions to reduce a specific cyber exposure, use of obsolete tools and services that can put your organization at risk.

With Cowbell, policyholders can visualize and understand their cyber risk whenever they want, and most importantly access recommendations on how to resolve identified security weaknesses.

5. Expedited Policy Issuance

Due to our simplified insurance application process, it only takes minutes from the time an agent starts creating a quote to the time the policy gets bound and activated! Agents can create several quotes with different coverages and limits for the policyholder to choose from. If all parameters fit within pre-defined thresholds, the policy is instantaneously bound (read about Moo, our underwriting side-kick in a recent blog). Issuing a bound policy can be done in 5 minutes or less, and once that is done, and the policy is signed, it gets activated immediately.

6. Admitted Insurance

Cowbell Cyber is focused on admitted cyber insurance. That means that we have taken all the required steps in order to be approved and backed by a state guarantee fund.

For policyholders and agents, that means that we can serve our policies with no unnecessary delays. Many states require three declinations to be obtained from admitted insurance companies before a policy can be placed on a surplus line. As an admitted insurance program, Cowbell Prime removes that due diligence and unnecessary friction in the adoption of insurance.

7. Cyber Risk Peer benchmarking

Additionally to the 7 Cowbell Factors mentioned above, a company aggregate factor is generated during every risk assessment, together with an industry aggregate. This enables policyholders to gain an understanding of their cyber risk profile compared to industry peers. The same score system from 0 to 100 is used in order to show the risk that the company is exposed to, and the average risk score for its industry. That helps policyholders understand further where they stand in terms of cybersecurity.

8. Cyber Awareness Training

A recent survey showed that only 5% of users were able to consistently recognize phishing emails and texts. Most cyber incidents, including ransomware attacks, start with users clicking on a malicious link. Tools can scan for spam emails but the best protection is to empower employees to be your first line of defense and train them regularly on cyber awareness. Cowbell has partnered with Wizer to offer cyber insurance training at no additional cost to its policyholders. This includes general security awareness but also phishing simulation, best practices to manage passwords, and more.

We recently interviewed Wizer’s founder, Gabriel Friedlander, on his company and the importance of cyber awareness training. You can find the interview here.

9. Digital, simplified application process

Cowbell Cyber brings numerous innovations to cyber insurance, including the ability to simplify and expedite the insurance application process. There is no more mountain of paperwork that needs to be completed, and hundreds of questions to be answered. Almost everything we need to know is automatically collected, requiring only validation by the policyholder, which makes getting insured for cyber as easy as ever.

10. Clarity of coverage and policy terms

“Making cyber insurance easy” is our mission. That includes having clarity over what exactly is covered. We believe that agents and policyholders alike need to understand policy terms, and the coverages included. We are actively trying to lift the veil of secrecy around cyber, explaining coverages without the circuitous jargon.

11. Closed-loop cyber risk management

Lastly, we want to mention the added advantage of Cowbell’s cyber policies.

Through our Cowbell Factors, Cowbell Insights, tools, and services, we enable insureds to implement a closed-loop approach to cyber risk management. We don’t want to just be there after an incident occurs. We want to help businesses fully understand cyber risk – what it is, how it can be improved, how incidents can be prevented, and lastly how to best respond and recover from incidents.

After all, both the insurer and the insured want to prevent incidents.

Through this closed-loop management style, businesses are insured if something happens. But they also have tools to actively try to avoid incidents.

Our insurance programs are only successful if the businesses we serve gain significant value from our policies. With that in mind, we created Cowbell Cyber relying on cutting-edge technology aiming for relevant coverages and a superior user experience.

If you are interested in insuring your business with Cowbell Cyber, contact your agent or our sales team at ntrapvrf@pbjoryyplore.nv.